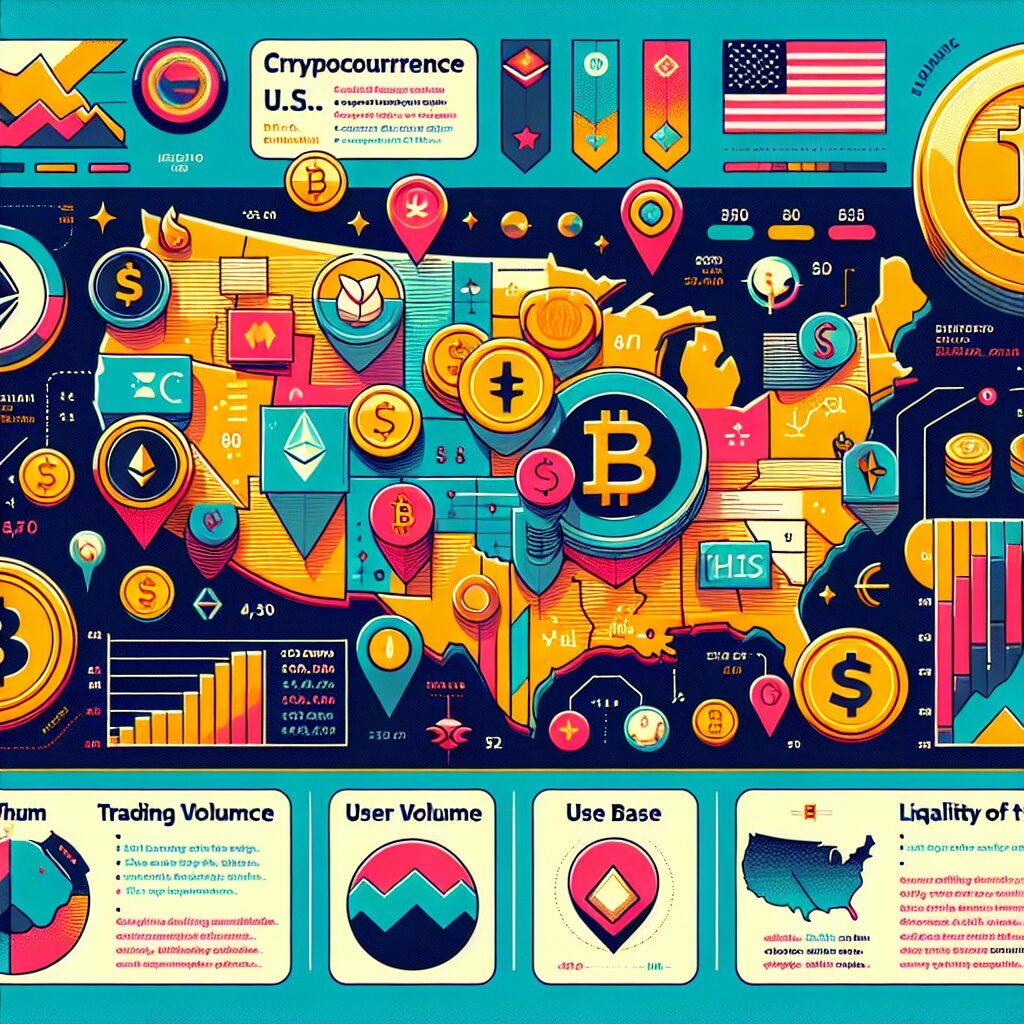

– Overview of U.S. Crypto Exchange Landscape

The U.S. crypto exchange landscape is characterized by a diverse array of platforms, each offering unique features and services to cater to the varying needs of investors and traders, reflecting the dynamic and rapidly evolving nature of the cryptocurrency market. As the popularity of digital currencies continues to grow, these exchanges strive to differentiate themselves by providing innovative trading tools, competitive fee structures, and robust security measures, ensuring users have access to a safe and efficient trading environment. The landscape is further shaped by regulatory developments, which play a crucial role in influencing how exchanges operate, as they must adhere to compliance requirements to maintain their legitimacy and protect their users. This creates a complex environment where exchanges must balance the need for innovation with the necessity of adhering to regulatory standards, all while striving to offer user-friendly interfaces and seamless trading experiences. As the market continues to mature, the U.S. crypto exchange landscape is poised for further transformation, driven by technological advancements and an increasing emphasis on transparency and security.

– Evaluating Security Measures Across Platforms

In the ever-evolving landscape of cryptocurrency exchanges in the United States, evaluating security measures across various platforms has become a critical factor for users seeking to safeguard their digital assets. As cyber threats continue to grow in sophistication and frequency, exchanges must prioritize robust security protocols to protect users’ funds and personal information. This involves implementing advanced encryption technologies, employing multi-factor authentication, and maintaining secure cold storage for the majority of their digital assets. Additionally, regular security audits and penetration testing are essential practices that help identify potential vulnerabilities before they can be exploited by malicious actors. Exchanges that prioritize transparency by openly sharing their security measures and incident response strategies tend to instill greater confidence among their users. Furthermore, collaboration with industry leaders and adherence to best practices in cybersecurity can enhance an exchange’s reputation as a secure platform. As users become more informed about security risks, they are likely to gravitate towards exchanges that demonstrate a strong commitment to protecting their interests.

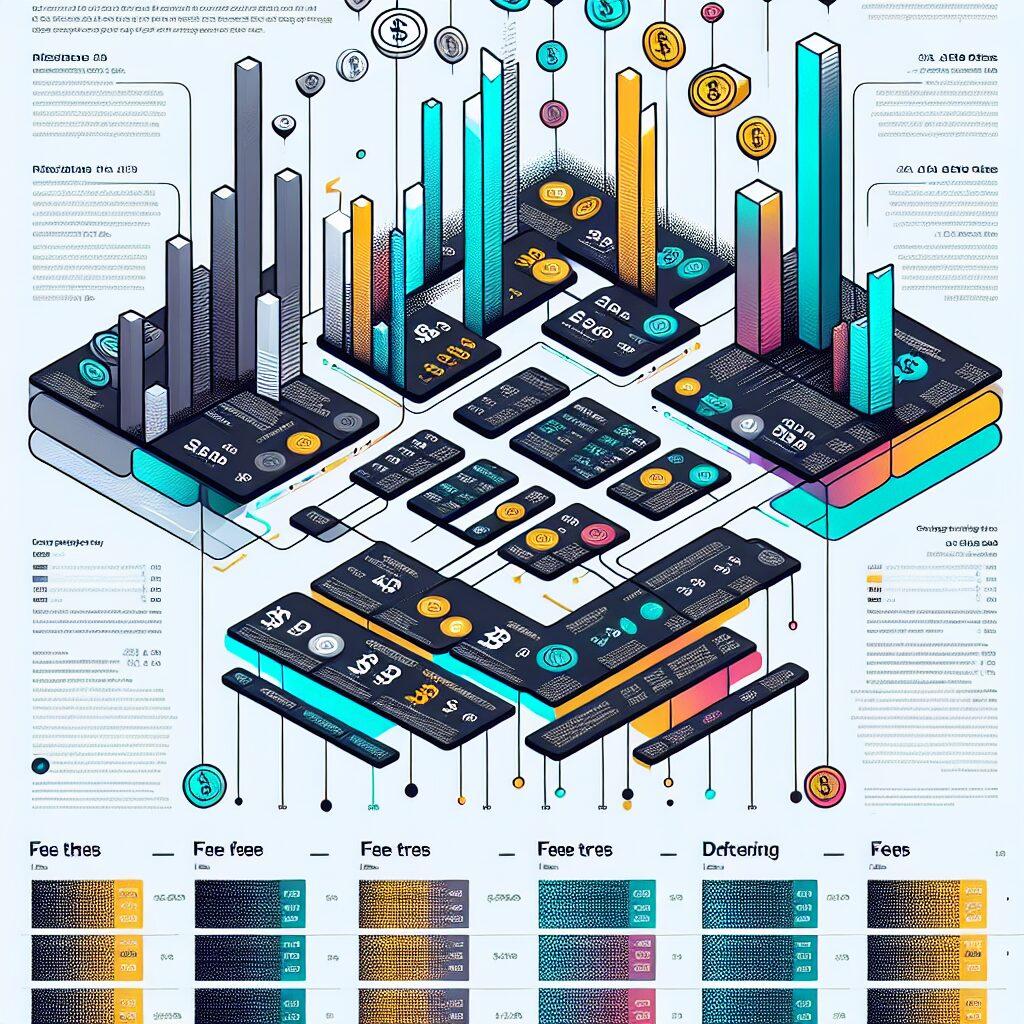

– Comparing Fee Structures: Which Exchange Offers the Best Value?

When comparing fee structures across various U.S. crypto exchanges, it becomes crucial for investors and traders to carefully consider which platform offers the best value, as fees can significantly impact the overall cost-effectiveness of trading activities. Many exchanges employ a tiered fee structure that varies depending on the user’s trading volume, with higher volume traders often benefiting from reduced fees, thereby encouraging more active trading. It is also important to note that some exchanges might charge additional fees for deposits and withdrawals, which can further influence the overall cost and should be taken into account when making a decision. Additionally, certain platforms may offer incentives, such as fee discounts for using their native tokens, which can provide further savings for users who choose to engage with these specific exchanges. By meticulously analyzing the fee schedules and potential hidden costs associated with each platform, traders can make informed decisions that align with their financial goals, ensuring that they select an exchange that not only meets their trading needs but also offers the most advantageous fee structure.

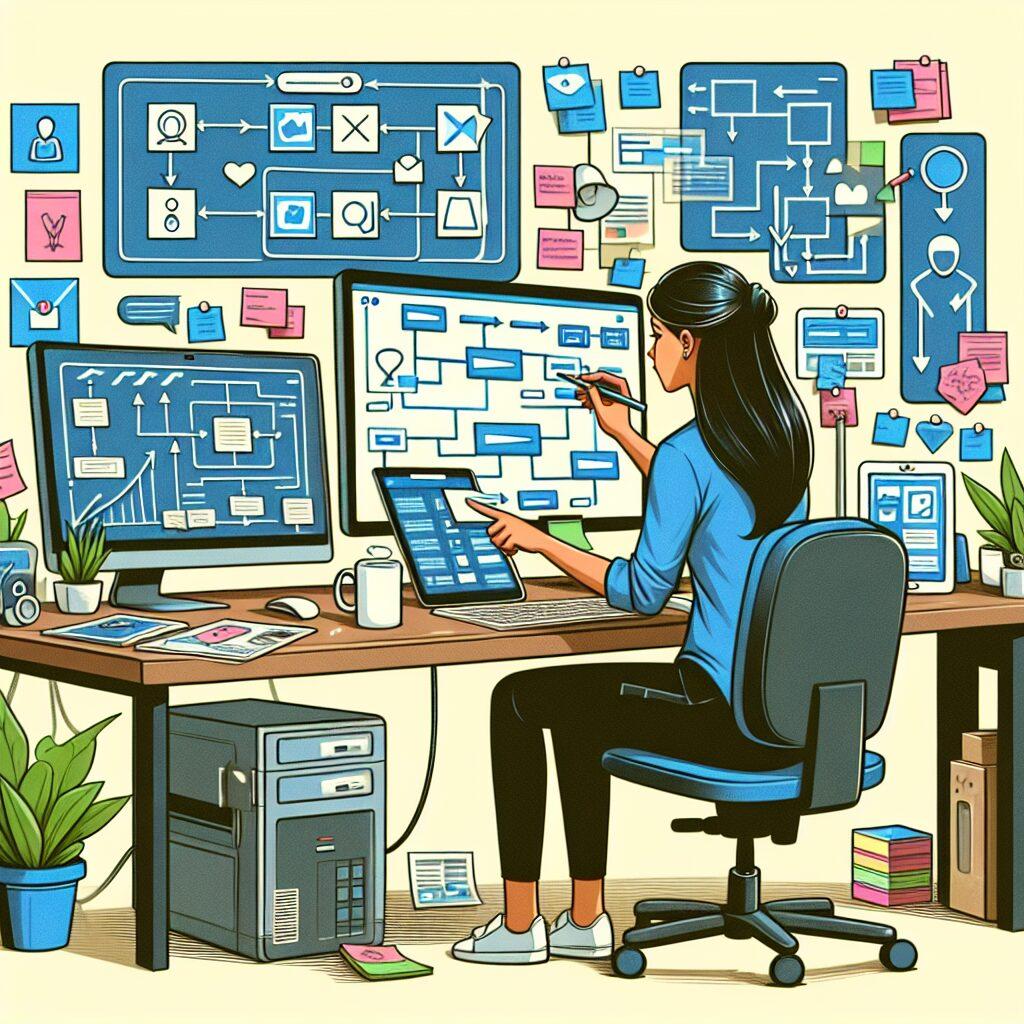

– User Experience and Interface: Navigating Your Options

When navigating the diverse landscape of U.S. crypto exchanges, the user experience and interface play a pivotal role in determining how effectively users can engage with the platform, making it crucial for exchanges to prioritize intuitive design and seamless functionality. A well-designed interface not only enhances accessibility for beginners but also provides seasoned traders with the tools they need to execute complex trades efficiently, thereby catering to a broad spectrum of users with varying levels of expertise. By integrating features such as customizable dashboards, real-time data analytics, and responsive customer support, exchanges can significantly improve user satisfaction and foster a loyal customer base. Furthermore, ensuring that the platform is compatible with multiple devices, including mobile and desktop, allows users to trade conveniently from anywhere, thus expanding the platform’s reach and usability. As the crypto market continues to evolve, exchanges must remain adaptable, consistently updating their interfaces to incorporate the latest technological advancements and user feedback, ensuring that they remain competitive and user-centric in a rapidly changing environment.

– Regulatory Compliance and Its Impact on Exchanges

In the ever-evolving landscape of cryptocurrency exchanges in the United States, regulatory compliance has emerged as a pivotal factor that significantly influences the operation and reputation of these platforms, as it not only ensures adherence to legal standards but also fosters trust among users who prioritize security and transparency in their trading activities. The complex framework of regulations governing crypto exchanges requires these platforms to implement robust anti-money laundering (AML) and know-your-customer (KYC) protocols, which are essential in mitigating fraudulent activities and enhancing the overall integrity of the financial ecosystem, thereby making compliance a cornerstone of sustainable growth and market acceptance. Moreover, exchanges that proactively engage with regulatory bodies and demonstrate a commitment to upholding the highest standards of compliance often find themselves better positioned to adapt to future legislative changes, which can be advantageous in maintaining a competitive edge in an industry characterized by rapid innovation and shifting regulatory landscapes. Consequently, for both seasoned traders and newcomers to the crypto market, the regulatory posture of an exchange serves as a critical criterion in the decision-making process, as it directly impacts the safety of their investments and the reliability of the trading environment.

– Future Trends in the U.S. Crypto Exchange Market

As we look toward the future trends in the U.S. crypto exchange market, it becomes increasingly apparent that technological advancements and regulatory developments will play pivotal roles in shaping the landscape, as exchanges strive to offer more secure, efficient, and user-friendly platforms to attract a broader range of investors. One significant trend is the anticipated integration of artificial intelligence and machine learning technologies, which are expected to enhance trading algorithms, improve risk management, and provide personalized user experiences, thereby making trading more intuitive and accessible for both novice and experienced traders. Additionally, the growing emphasis on regulatory compliance is likely to lead to more transparent and standardized practices across exchanges, potentially increasing investor confidence and fostering a more stable market environment. Furthermore, as the demand for diversified digital assets continues to rise, exchanges may expand their offerings to include a wider array of cryptocurrencies and tokenized assets, thereby catering to the evolving preferences of investors and potentially driving further market growth.