Understanding Crypto Whales: Who Are They?

Understanding crypto whales is essential for anyone looking to navigate the intricate world of cryptocurrency, as these large holders significantly influence market dynamics and price movements, and they are typically defined as individuals or entities that possess substantial amounts of cryptocurrency, often enough to sway market trends with their buying or selling decisions. These whales can be early investors, large institutions, or even cryptocurrency exchanges, and their behavior can provide valuable insights into market sentiment, as their transactions often signal shifts in supply and demand that may affect the overall market landscape. By closely monitoring their activities, investors can gain a better understanding of potential price movements, as well as the underlying motivations driving these significant transactions, which can range from accumulation during market dips to strategic selling when prices peak. Thus, analyzing the actions of these influential players can be a key component in developing a successful investment strategy in the ever-evolving crypto market.

The Impact of Whale Transactions on Market Dynamics

The impact of whale transactions on market dynamics is significant, as these large holders possess the ability to influence price movements and market sentiment through their buying and selling activities, which often leads to increased volatility that can affect both retail investors and smaller traders alike. When a whale decides to accumulate a substantial amount of a cryptocurrency, this action can signal confidence in the asset, prompting other investors to follow suit and potentially driving prices upward, whereas large sell-offs by whales can trigger panic among smaller investors, resulting in a rapid decline in prices due to the sudden influx of sell orders. Consequently, understanding the behavior of these crypto whales is essential for market participants, as their transactions often serve as indicators of broader market trends, and by analyzing their movements, traders can gain insights into potential price fluctuations and make more informed decisions about their own trading strategies. Therefore, keeping a close eye on whale activity can provide valuable information that may enhance one’s ability to navigate the complex and often unpredictable cryptocurrency market.

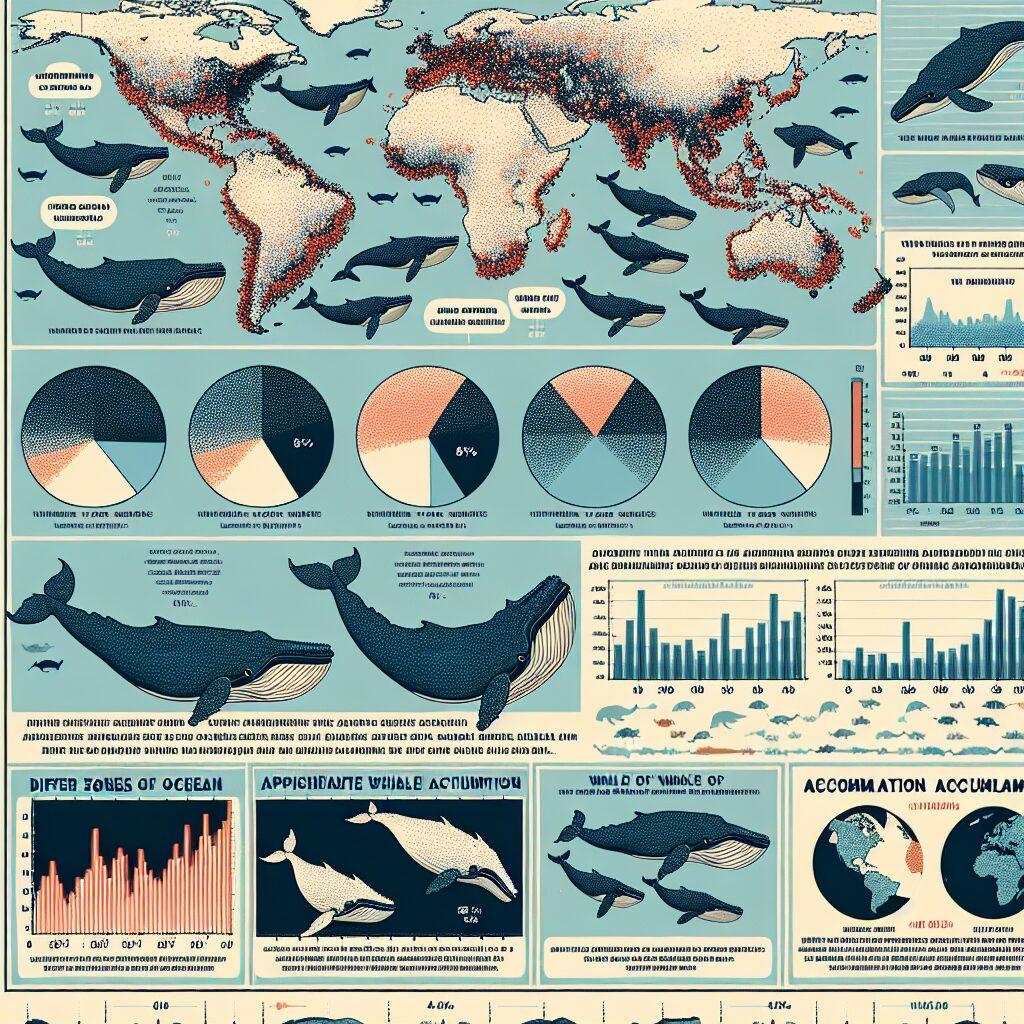

Analyzing Whale Accumulation Patterns

In the realm of cryptocurrency, understanding whale accumulation patterns is crucial, as these significant players often hold substantial amounts of digital assets, which can lead to notable market shifts and influence price trends. When we analyze how whales accumulate their assets, we observe distinct behaviors that can provide insights into their strategies, revealing that they tend to buy during periods of price dips or market corrections, which indicates their confidence in the long-term value of the assets they are acquiring. Moreover, these accumulation patterns can signal potential bullish trends, as the increased buying activity by whales often precedes price rallies, suggesting that they are positioning themselves for future gains.

Additionally, tracking the frequency and volume of whale transactions allows us to gauge market sentiment, as large-scale purchases can reflect a belief in the underlying fundamentals of a cryptocurrency, while a sudden increase in selling activity may raise concerns about potential downturns. Consequently, by closely monitoring these behaviors, investors can better navigate the complex landscape of cryptocurrency trading and make more informed decisions based on the movements of these influential market participants.

Whale Selling Strategies: When and Why They Dump

In the realm of cryptocurrency, understanding the strategies employed by whales—those individuals or entities holding substantial amounts of a cryptocurrency—is crucial for comprehending market dynamics, particularly when it comes to their selling behaviors. Whale selling strategies often manifest during pivotal moments in the market, such as when prices reach significant resistance levels or when broader economic indicators suggest a downturn, prompting these large holders to liquidate their assets to realize profits or mitigate losses. Moreover, the motivations behind these sell-offs can vary widely, from a desire to capitalize on favorable market conditions to a reactionary response to news events or regulatory changes that may impact the perceived value of their holdings. By analyzing these patterns, traders and investors can gain insights into potential price movements and market sentiment, allowing them to make more informed decisions. Consequently, tracking whale activity not only aids in predicting market trends but also highlights the importance of remaining vigilant and responsive to the signals that these influential players send through their trading actions.

The Role of Whale Activity in Price Predictions

The role of whale activity in price predictions is a crucial aspect of understanding market dynamics within the cryptocurrency landscape, as these large holders, often referred to as whales, possess the ability to significantly influence price movements through their buying and selling behaviors, which can create ripples across the market. When whales accumulate large quantities of a particular cryptocurrency, it often signals a bullish sentiment, suggesting that they anticipate a price increase in the near future, while their decision to sell can indicate a bearish outlook, leading to potential declines in market value. By closely monitoring these patterns, traders and investors can gain valuable insights into market trends and make more informed decisions regarding their own trading strategies, as the actions of whales often precede larger market movements. Consequently, understanding the motivations behind whale transactions and the timing of their trades can provide essential clues for predicting future price fluctuations, making whale activity a critical focal point for anyone looking to navigate the complexities of the cryptocurrency market effectively.

Tracking Whale Movements: Tools and Techniques

Tracking the movements of crypto whales, who are often defined as individuals or entities holding significant amounts of cryptocurrency, requires a combination of advanced tools and analytical techniques that can provide insights into their trading behaviors and strategies. Many investors and analysts utilize blockchain explorers, which allow them to monitor large transactions and wallet addresses, thereby gaining a clearer picture of when and where these whales are moving their assets. Additionally, specialized analytics platforms offer features that track historical data and real-time movements, enabling users to identify patterns that may signal impending market shifts or trends. By employing on-chain analysis, one can discern not only the volume of transactions but also the frequency and timing, which are crucial for understanding the broader implications of whale activity on market dynamics. Furthermore, social media sentiment analysis can complement these tools by providing context around whale movements, as public sentiment can often influence price fluctuations and market reactions, making it essential for traders to stay informed about both quantitative data and qualitative insights.